If you’ve been trading for a while, you know that building a diversified portfolio can be challenging, especially when you’re working with only a few strategies. After discovering AlgoCloud’s stockpicking feature, I was able to improve my approach and strengthen my portfolio without the hassle of coding. In this article, I’ll share how AlgoCloud helped me achieve a more balanced portfolio and consistent profits by simplifying the entire process.

Before I found AlgoCloud, I felt overwhelmed by the need to create dozens of strategies to trade successfully across multiple markets. Many trading platforms require complex coding, making it difficult to quickly create and test strategies. I spent more time learning to code than actually trading.

Everything changed when I started using AlgoCloud. The platform’s no-code drag-and-drop editor allows you to visually create strategies without needing to write a single line of code. This simplified approach let me focus on the strategy logic rather than the technical programming details.

One of AlgoCloud’s most powerful features is its stockpicking functionality. Unlike other platforms where you need hundreds of strategies to diversify, AlgoCloud allows you to apply a few well-thought-out strategies across thousands of stocks. This made it much easier for me to achieve diversification without the complexity.

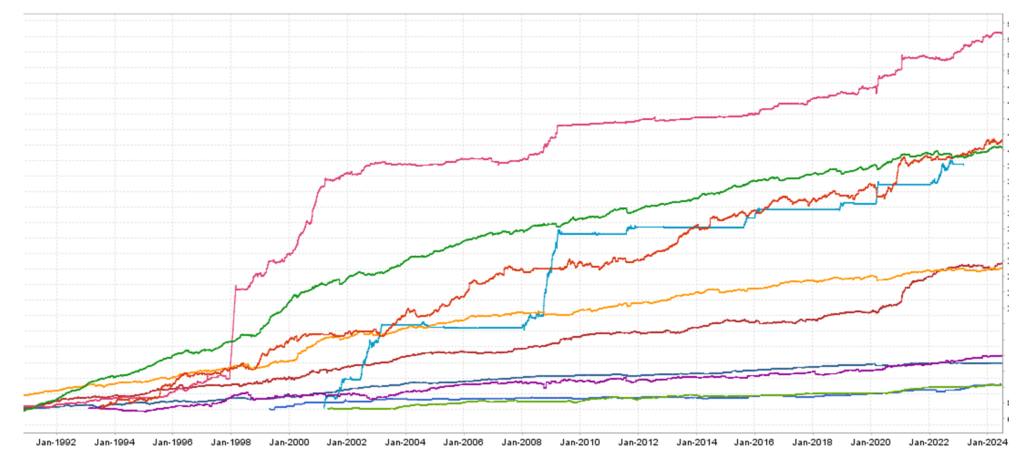

Currently, I run 10 strategies across thousands of stocks, and the results have been impressive. AlgoCloud automatically picks the stocks that meet my strategy conditions and executes trades. The platform even includes up-to-date data on U.S. stocks and ETFs, with adjustments for survivorship bias, so I know the data I’m working with is reliable.

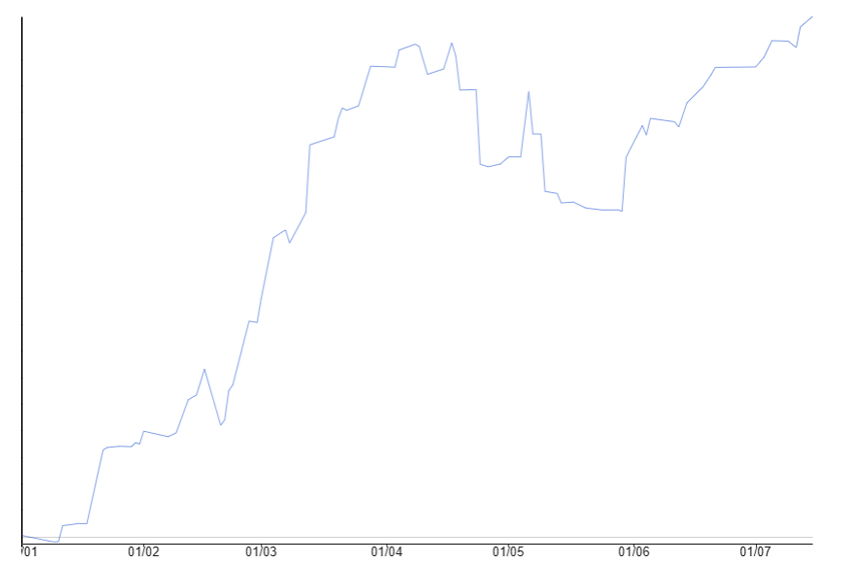

During my demo tests, I saw a steady equity curve, and after three months, I decided to go live. In just six months of live trading, my account saw a 19% profit. I added four more strategies to my portfolio along the way, and AlgoCloud has handled everything efficiently. The best part is, I don’t need to manage the trades manually—AlgoCloud does it all, from picking the stocks to executing the trades.

Live Portfolio Equity Growth (January 2024 – July 2024) with 19% grow

AlgoCloud’s stockpicking feature has also given me peace of mind during times when the markets are down. Since my portfolio is diversified across thousands of stocks, it’s less sensitive to short-term volatility. I’ve even built strategies designed to perform well when other strategies struggle. For example, one of my strategies buys stocks during market downturns, filling a gap when other strategies are in drawdown.

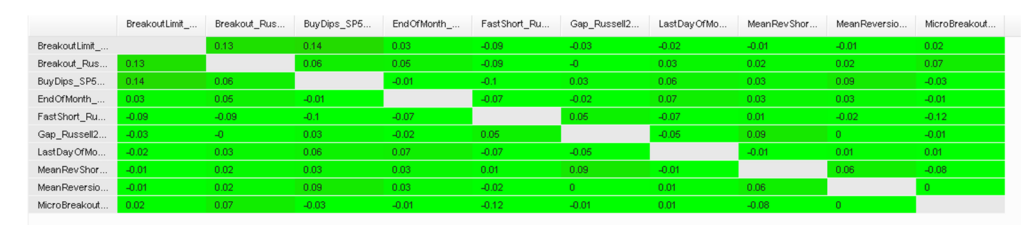

Another important factor in my success is correlation management. In trading, minimizing the correlation between strategies is key to achieving true diversification. Thanks to AlgoCloud, I can easily check the correlation between my strategies to ensure that they’re not too closely linked. This has allowed me to build a portfolio where each strategy contributes to overall performance in its own way.

Of course, all of this wouldn’t mean much without strong backtesting. AlgoCloud allows me to run backtests for my entire portfolio to ensure that my strategies are performing as expected over long periods. The backtests have confirmed the strength of my strategies and helped me make adjustments when needed.

One thing I really appreciate about AlgoCloud is the team behind it. I’ve met the creators personally, and they’re not just developers—they’re traders who understand the real-world challenges we face. They’re constantly improving the platform, and they even have plans to integrate AlgoCloud with Prop trading firms, giving traders access to additional capital. That forward-thinking approach is why I trust AlgoCloud for my trading.

In conclusion, AlgoCloud has made it easier for me to build a strong, diversified portfolio without getting bogged down by the technical side of trading. Its no-code platform and stockpicking feature have allowed me to focus on creating strategies that work, and the correlation management ensures that my portfolio is balanced. If you’re looking for a way to manage your investments efficiently and reduce stress, I highly recommend giving AlgoCloud a try.

This website is operated by AlgoWizardCloud LLC.

AlgoCloud.com is a technology platform and publisher, not a registered broker-dealer or registered investment adviser, and does not provide investment advice.

Investing involves risk and investments may lose value. Risk capital is money that can be lost without jeopardizing ones’ financial security or life style. Only risk capital should be used for trading and only those with sufficient risk capital should consider trading. Past performance is not indicative of future results. Seek appropriate financial, taxation and legal advice before making any investments.

Risk Disclosure:

Trading contains substantial risk and is not for every investor. An investor could potentially lose all or more than the initial investment. Risk capital is money that can be lost without jeopardizing ones’ financial security or life style. Only risk capital should be used for trading and only those with sufficient risk capital should consider trading. Past performance is not necessarily indicative of future results.

Hypothetical Performance Disclosure:

Hypothetical performance results have many inherent limitations, some of which are described below. no representation is being made that any account will or is likely to achieve profits or losses similar to those shown; in fact, there are frequently sharp differences between hypothetical performance results and the actual results subsequently achieved by any particular trading program. One of the limitations of hypothetical performance results is that they are generally prepared with the benefit of hindsight. In addition, hypothetical trading does not involve financial risk, and no hypothetical trading record can completely account for the impact of financial risk of actual trading. for example, the ability to withstand losses or to adhere to a particular trading program in spite of trading losses are material points which can also adversely affect actual trading results. There are numerous other factors related to the markets in general or to the implementation of any specific trading program which cannot be fully accounted for in the preparation of hypothetical performance results and all which can adversely affect trading results.

Risk Disclosure:

Broker disclaimer:

Interactive Brokers, Alpaca, XTB brokers are not affiliated with AlgoCloud.com and do not endorse or recommend any information or advice provided by AlgoCloud.com